HOW DOES SOLE TRADER APPLY FOR JOBKEEPER

Heres the simple instructions with images how to do that. It comes down to meeting the entity eligibility criteria and a major component of that is calculating a fall in GST turnover relative to a comparable period a year ago.

How To Apply For Jobkeeper For Sole Traders With Images Ato Tax Calculator

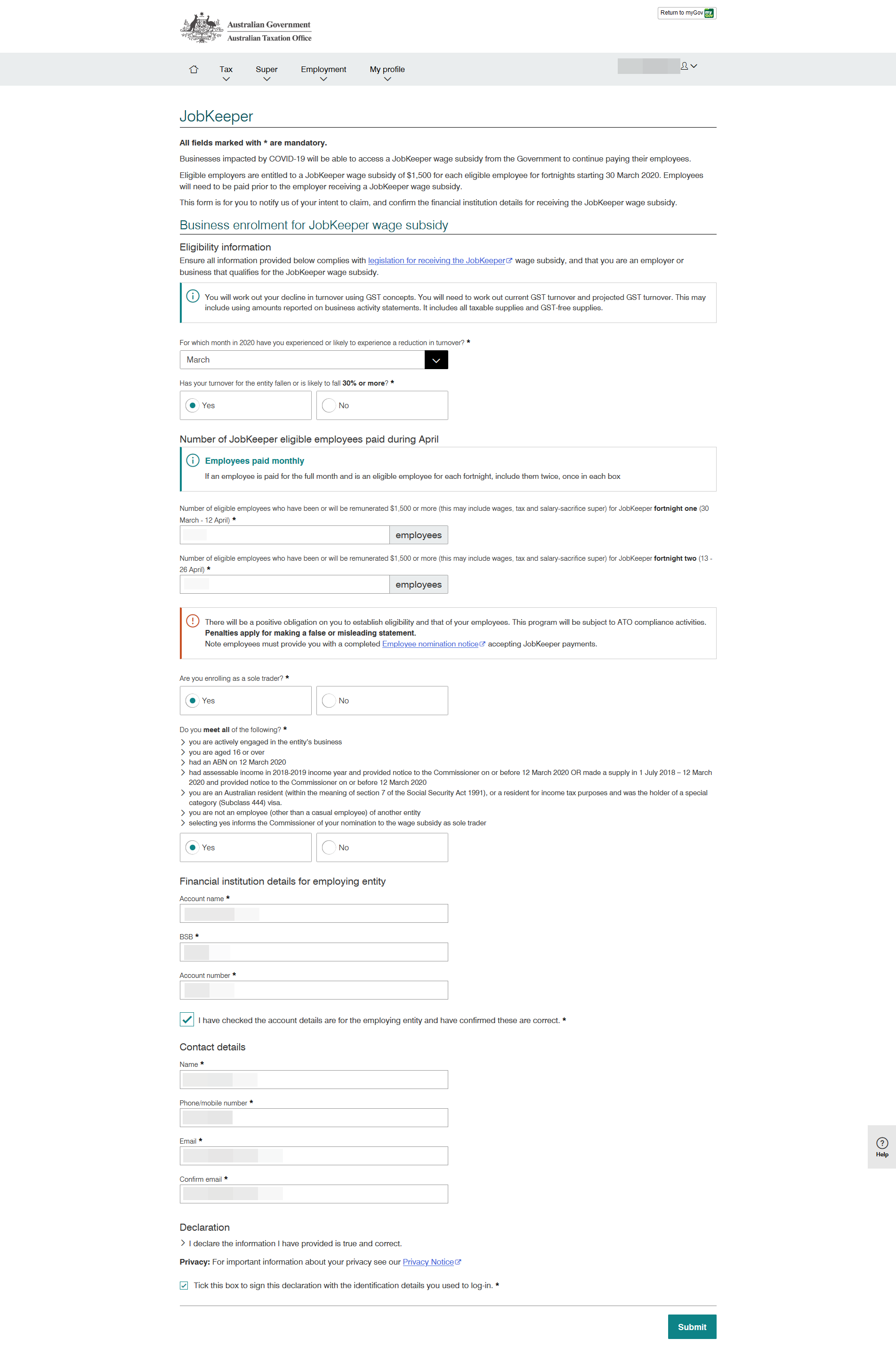

Log in to complete the online form.

HOW DOES SOLE TRADER APPLY FOR JOBKEEPER. Login to your myGov account. Employers may be eligible for the JobKeeper Payment scheme if all the following apply. If there are additional checks required or any errors made on your form it.

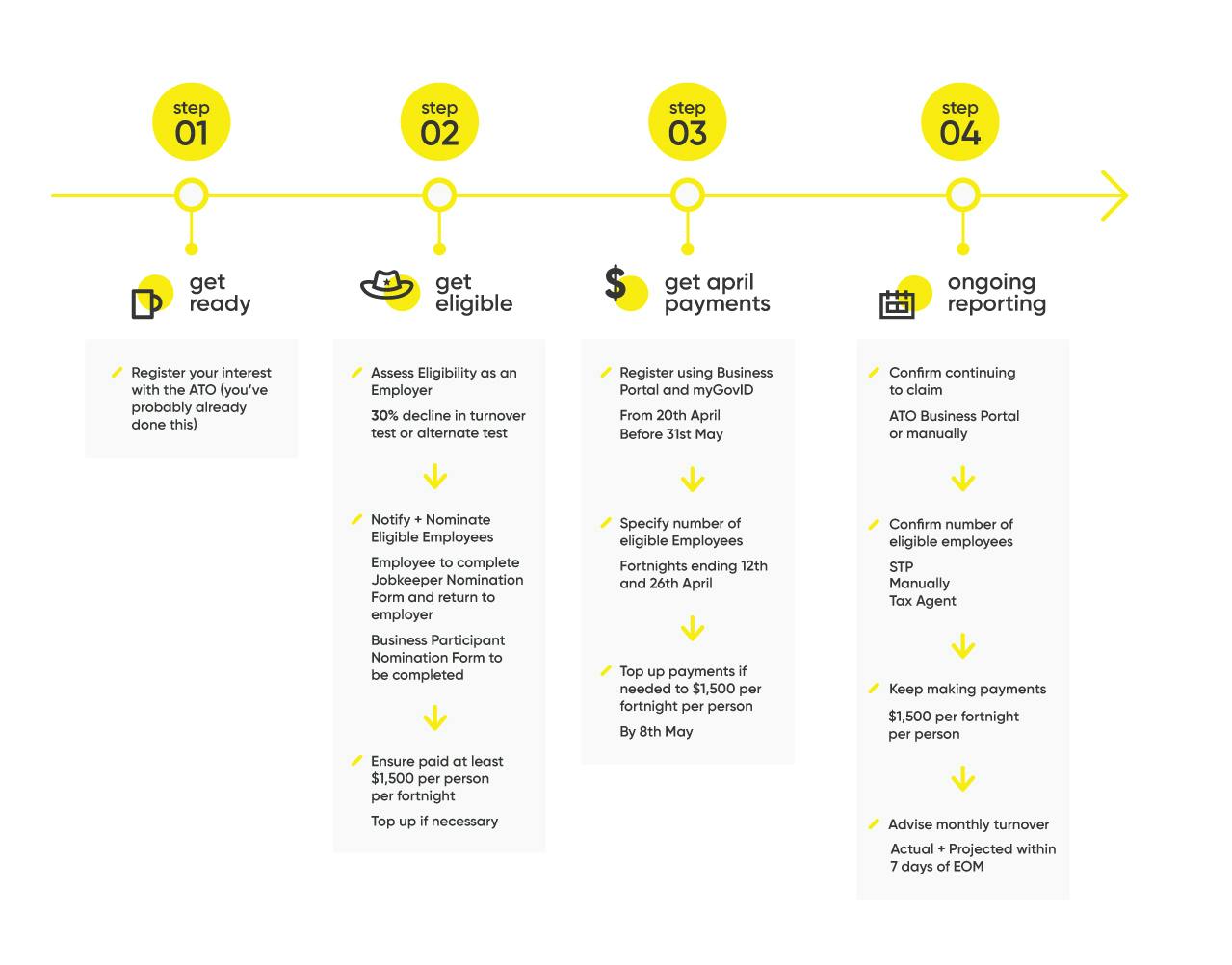

The JobKeeper guide for sole traders will help you through Steps 1-3 of your JobKeeper application. Not-for-profit organisation that pursued your objectives principally in Australia or. And in case you have worked for more than 20 hours a week before 1 March 2020 you now qualify for the higher tier of payment of the JobKeeper scheme.

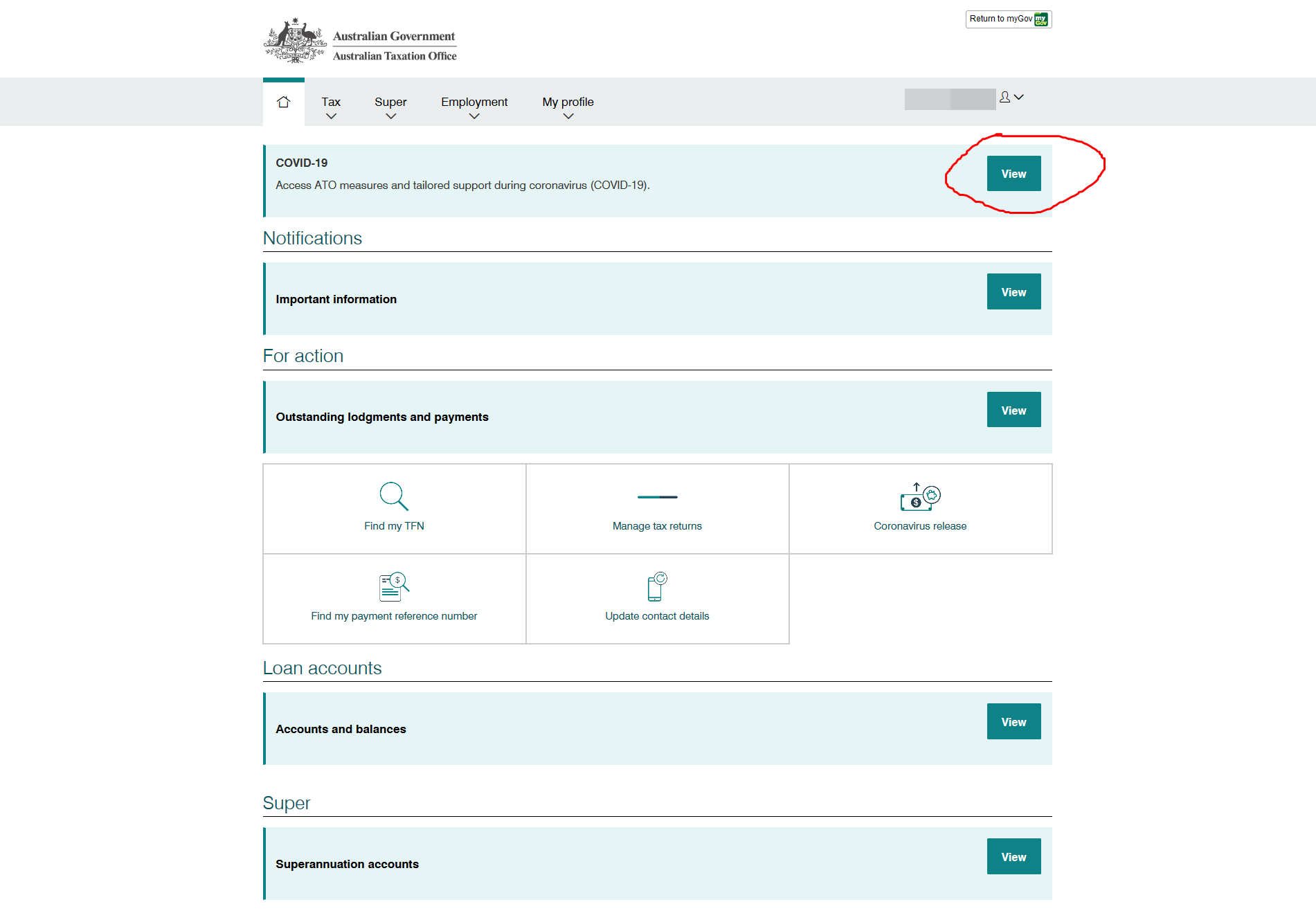

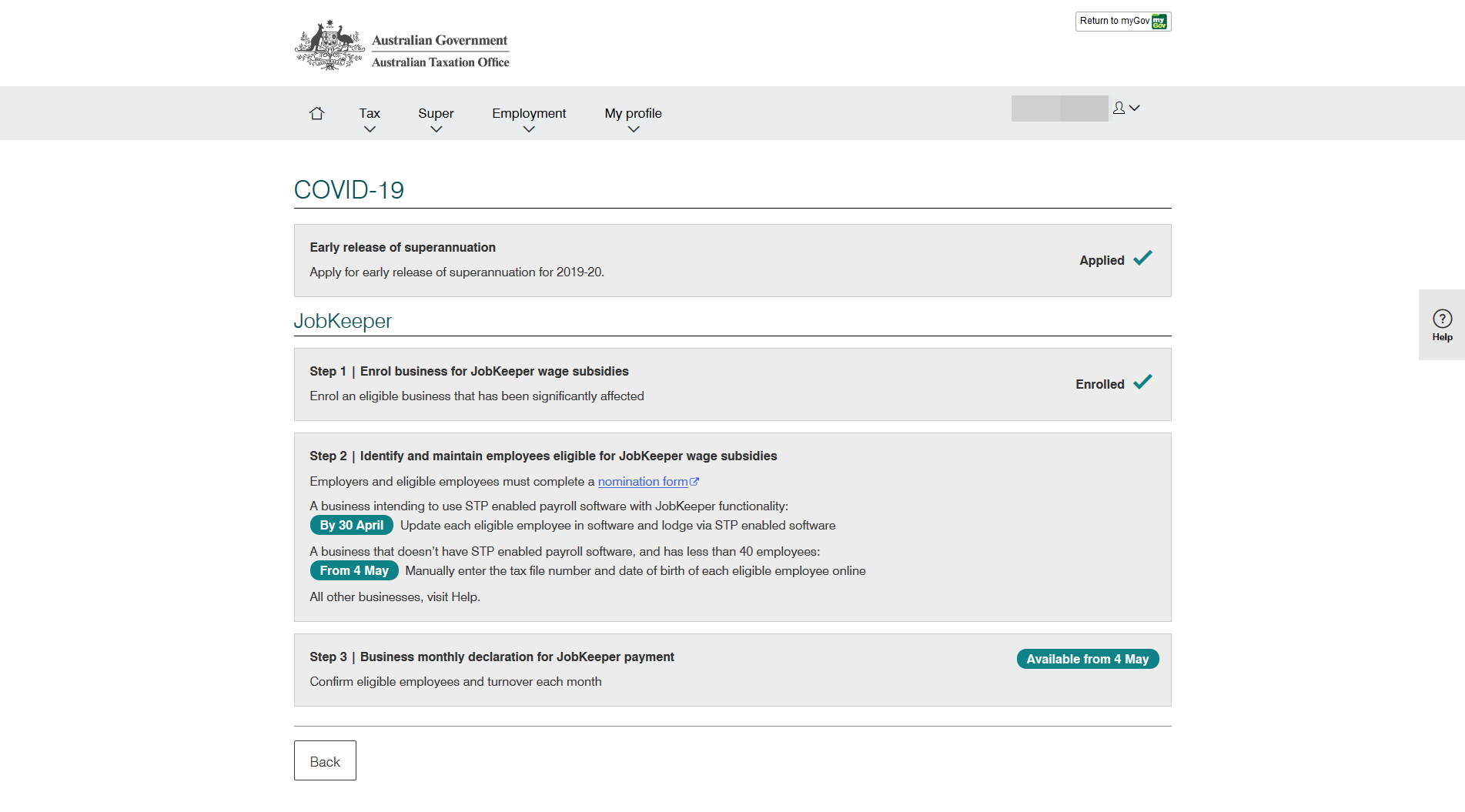

Enrol for the JobKeeper payment. If you are sole traderself-employed you can apply for jobkeeper payment on ATO online portal from April 20 2020. Follow these simple steps.

Provide your current and projected turnover. Sole traders with no employees. If you or your business got JobKeeper Payment its part of your gross business income.

This will support sole traders to maintain their income and connection with employees. From 30 March employers and sole traders can submit an expression of interestSole traders will receive the flat rate of 1500 per fortnight deposited directly. Under the JobKeeper rules sole traders are allowed to apply for the 1500 fortnightly payments as long as they meet the headline eligibility criteria applicable to other firms as well as some.

Sole traders may be eligible to receive the JobKeeper Payment if their turnover has reduced. Identify your eligible employees. Your STP-enabled payroll software has JobKeeper functionality.

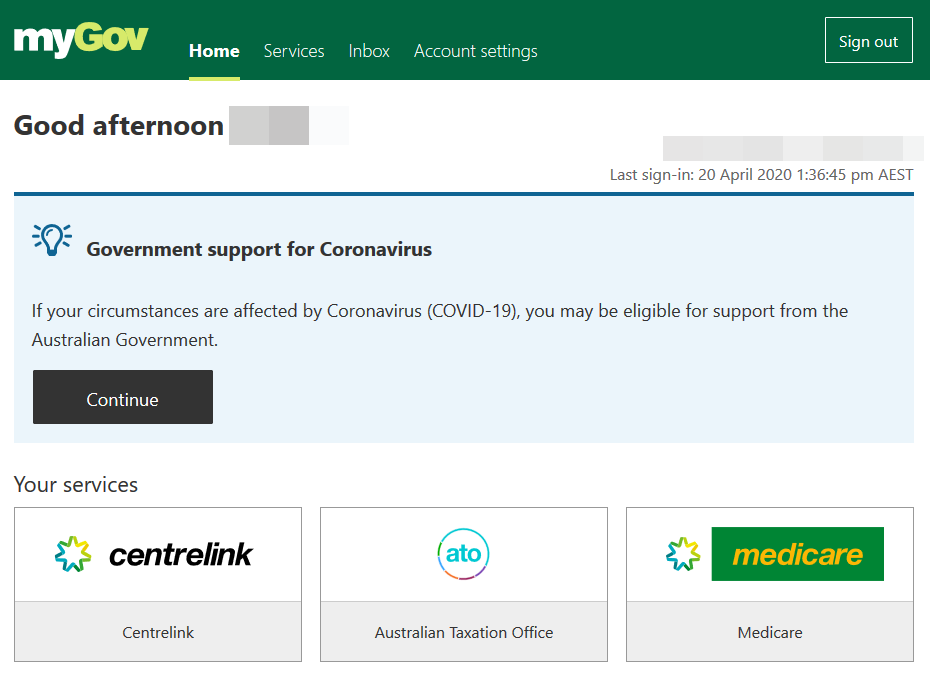

How sole traders can access the JobKeeper payment. If you received the JobKeeper Payment between 4 January and 28 March 2021 you may be eligible to apply for a business loan. Login to myGov and click on ATO.

Contact and financial institution details. This will be a ongoing indication to qualify for the JobKeeper. Look for a field called Assessable Government Industry Payments in the income section of the business schedule and enter your JobKeeper payments there.

Sole traders with employees. Coronavirus SME Guarantee Scheme If your business turnover is less than 50 million you may be eligible to access a loan to help your business recover. On 1 March 2020 you ran a business in Australia or were either a.

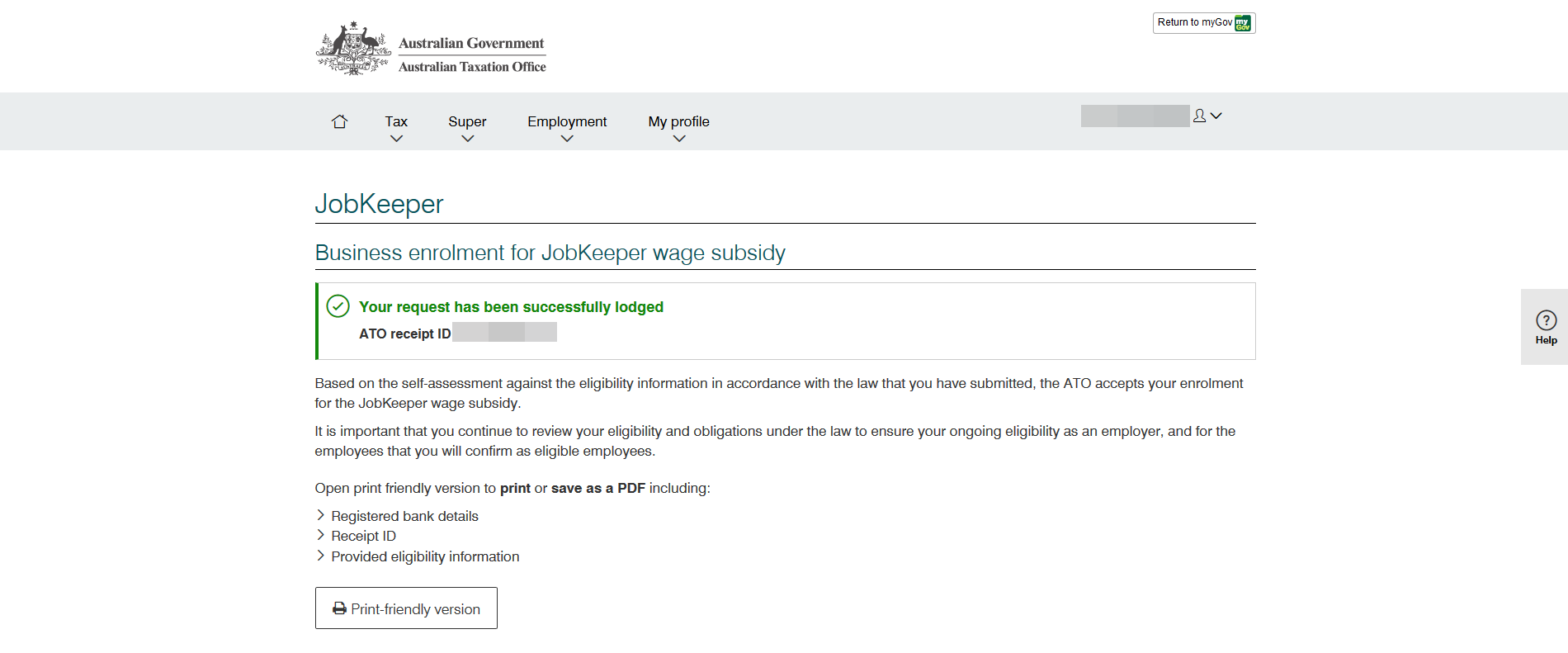

This week we look at the JobKeeper payment and which sole traders can apply. Complete enrolment - read our step by step enrolment guide here. The JobKeeper Payment scheme finished on 28 March 2021.

Check actual decline in turnover. Confirm your eligibility - read the eligibility criteria here. Click on the link to view the JobKeeper application process.

Broadly speaking if you are a sole trader and you have worked for less than 20 hours a week in the last four weeks before 1 March 2020 you will qualify for the lower tier of JobKeeper. Decline in turnover test percentage. Following registration by the eligible business the Government will provide 1500 per fortnight per eligible employee for a maximum of 6 months.

You should then see a banner similar to the one displayed below. For today simply click on enrol to access Step 1. Monthly business declarations for JobKeeper Fortnights in March need to be completed by 14 April 2021 to receive final JobKeeper payments.

Confirm eligible business participant. However accessing the JobKeeper payment as a non-employing sole trader may change your eligibility for other government payments as the income from the JobKeeper. Sole traders with no employees.

You will then arrive at a page similar to what is shown in the below screenshot. After this you should receive JobKeeper payments within five business days. Update each eligible employee in your payroll software and submit.

A sole traders guide to JobKeeper There has been some confusion around which self-employed businesses are entitled to the JobKeeper wage subsidy. Log in to ATO online services or the Business Portal. Last week we reported on the changes to the JobSeeker payment and how the coronavirus affected sole traders who had lost income.

If youre in a business partnership we use your share of the business income minus allowable deductions. If youre a sole trader we use all your business income minus allowable deductions. The last obligation as a Sole Trader is you will need to quantify each and every month thereafter that yourself and any applicable employees still qualify for the JobKeeper payment.

You must have myGov account that is linked to ATO tax portal. JobKeeper as a Sole Trader if you are not an employee and you got JobKeeper through your ABN as a sole trader then you must add your JobKeeper payments into the business schedule of your tax return. Confirm no eligible employees.

How To Apply For Jobkeeper For Sole Traders With Images Ato Tax Calculator

Jobkeeper For Sole Traders Identifying Yourself As The Eligible Business Participant Airtax Help Centre

Check Actual Decline In Turnover Australian Taxation Office

Step 3 Make A Business Monthly Declaration Australian Taxation Office

How To Apply For Jobkeeper For Sole Traders With Images Ato Tax Calculator

Step 2 Identify Your Eligible Employees Australian Taxation Office

Jobkeeper Payment For Sole Traders Stimulus Package

How To Apply For Jobkeeper For Sole Traders With Images Ato Tax Calculator

Step 2 Identify Your Eligible Employees Australian Taxation Office

Step 2 Identify Your Eligible Employees Australian Taxation Office

Applying For Jobkeeper A Step By Step Guide For Sole Traders Part 1 Youtube

Applying For Jobkeeper A Step By Step Guide For Sole Traders Part 2 Youtube

Essential Guide To Jobkeeper 2 0 For Sole Traders Airtax Help Centre

Step 1 Enrol For The Jobkeeper Payment Australian Taxation Office

How To Apply For Jobkeeper For Sole Traders With Images Ato Tax Calculator

Jobkeeper For Sole Traders Identifying Yourself As The Eligible Business Participant Airtax Help Centre

Our Step By Step Guide To Applying For Jobkeeper Payment Businessdepot

Jobkeeper For Sole Traders How To Make A Business Monthly Declaration Airtax Help Centre

Https Www Icb Org Au Out 222723 Ato Webpage Jk Sole Traders 2 May20 Pdf

Comments

Post a Comment